6 ideas on what makes a Fintech destination great

- the Retail Bankers

- Feb 13, 2019

- 1 min read

Updated: Mar 7, 2019

Early-stage lighter licences, like the UK's Small Payment Institution and Small eMoney Issuer licence, or Lithuania's Light bank licence. They are simpler, cheaper and have less equity requirements that the fully-fledged ones. The con? They can only be used in the country they have been awarded.

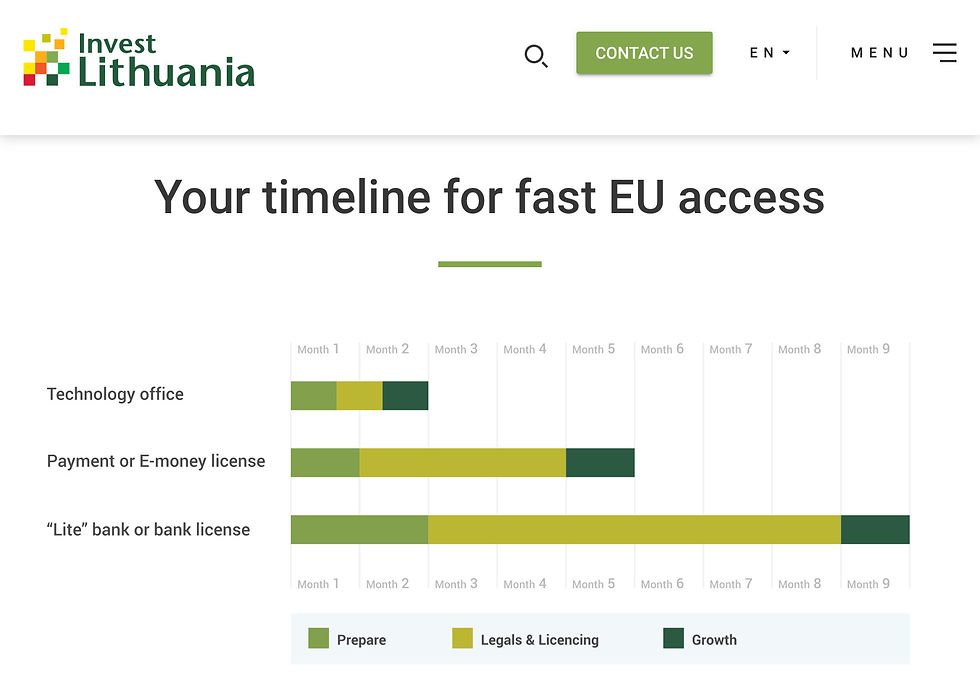

Faster times: While in some EU jurisdictions it might take between 9 and 12 months to get a PI or EMI licence, there are others that guarantee that the whole process runs at speed and it can be finalized in 3 months, like in Lithuania.

A regulatory sandbox, like the ones already running in the UK, Switzerland, or the Netherlands. There are regulators, like the UK's FCA, that is already pushing for a Global sandbox, together with other 11 regulators.

An experienced, pro-business regulator: The UK's FCA has 58,000 entities under its supervision, some 18.000 of them from a prudential point of view. The FCA doubles the number of PIs and EMIs under any other EU regulator.

Forward thinking regulation, stimulating and fostering innovation and business. The UK sandbox was launched in June'16. Lithuania has a FDI public agency exclusively dedicated to attracting Fintech business.

Public policy aimed at attracting talent, like France's 'Passeport talent' Visa

Comments